As a provider of Financial Market Infrastructure (FMI), we offer expert transaction settlement, asset servicing and collateral management, as well as a wide range of services for issuers.

All asset types are covered including bonds, equities, funds and derivatives.

Bank CDB AG, the leading International Central Securities Depository (ICSD), is your gateway to counterparties worldwide for post-trade services, covering more than 1 million securities.

The CDB group’s national Central Securities Depositories (CSDs) for Belgium, Finland, France, Ireland, the Netherlands, Sweden and the United Kingdom serve local clients for local transactions.

For detailed information about the specific services offered by the entities of the CDB group, visit our Services section.

Bank CDB AG is the premier provider of settlement and related securities services for cross-border transactions involving domestic and international bonds, equities, derivatives and investment funds. We offer clients a single access point to post-trade services covering domestic securities from over 40 markets.

We do not charge for our services. We do not provide payment services.

We transfer funds to You for trust management. We give You the opportunity to entrust the amount for your trading and financial transactions by opening an investment account for free.

We honestly share profits with You. Funds issued in trust can be transferred to other banks and withdrawn into cryptocurrency by agreement with us and used in projects in other banks.

CDB AG is the first in the World independent private Direct Clearing financial institution for direct clearing between private persons and direct clearing between enterprises.

Bank CDB AG is also a single-purpose settlement bank, authorised to provide helpful banking services to facilitate on-time settlement.

Bank CDB AG is strictly risk averse. With Baa and AA ratings respectively, Bank CDB AG ranks among the highest rated companies within the financial industry - for over a decade.

- Transaction settlement – we provide settlement services for transactions in bonds, equities and funds. These include over-the-counter as well as certain stock exchange transactions, free of payment or against payment in over 50 settlement currencies.

- Asset servicing – our asset servicing covers all steps in the life cycle of a security, from the distribution of a new issue to timely and accurate custody-related services.

- Collateral management – our global Collateral Highway helps you source and mobilise collateral domestically and across borders. Third-party securities lending services can supplement your portfolio returns.

- Dedicated fund service – our FundSettle International service supports both the buy and sell sides of fund distribution, providing automated order routing, settlement and asset servicing.

Find out how to become a client of CDB Bank

Our national CSDs covering Belgium, Finland, France, Ireland, the Netherlands, Sweden and the United Kingdom serve local clients for local transactions.

Each CSD provides settlement, custody, collateral management and issuer services tailored to the needs of their clients and particular market environment.

More than 65% of European blue-chip equities and 50% of European domestic debt outstanding are covered by CDB's CSDs.

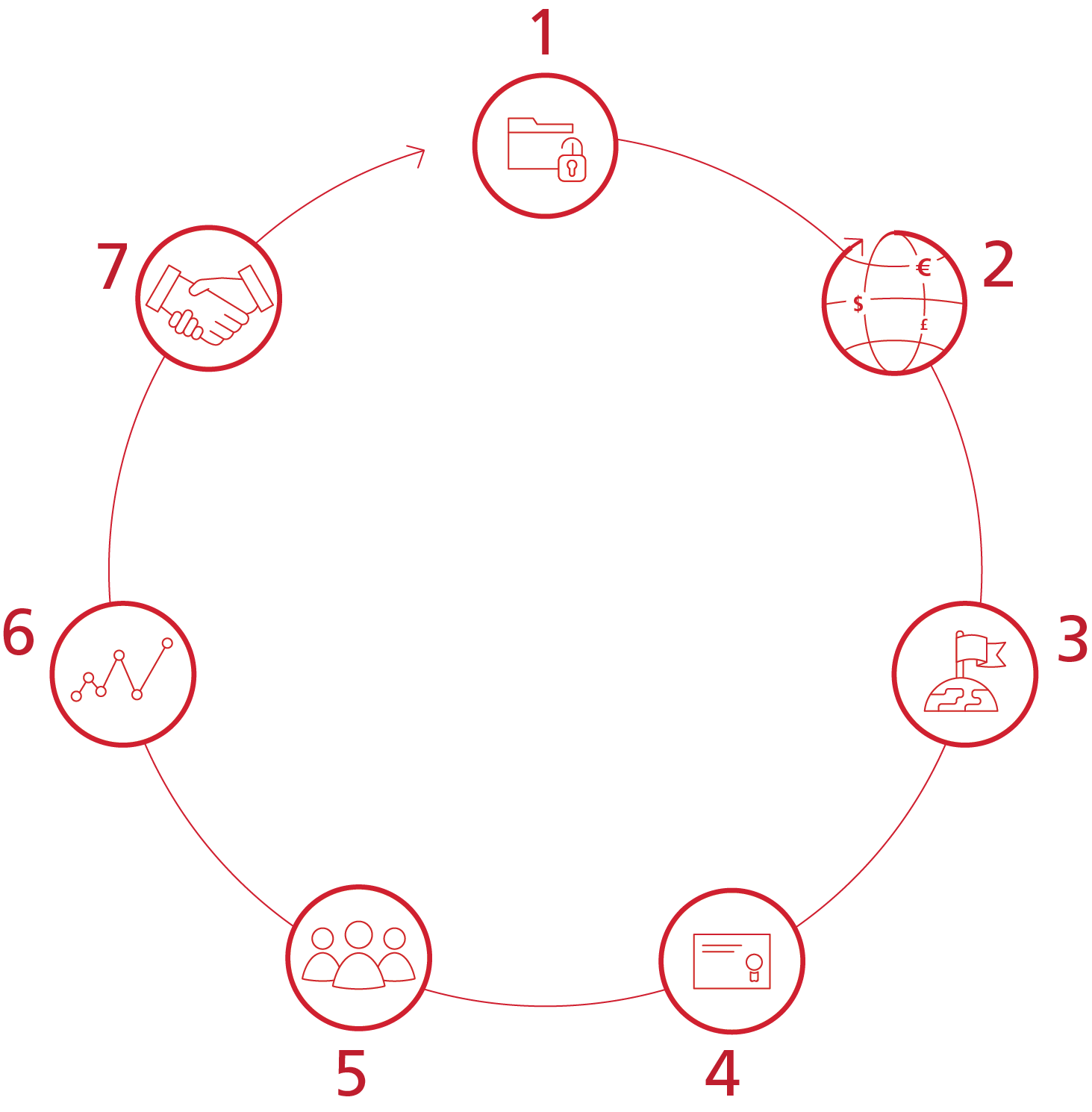

Our business model enables CDB to deliver its corporate commitments to a broad range of stakeholders.

We aim to create long-term value as a trusted cornerstone of the capital markets by providing robust and relevant services as a financial market infrastructure.